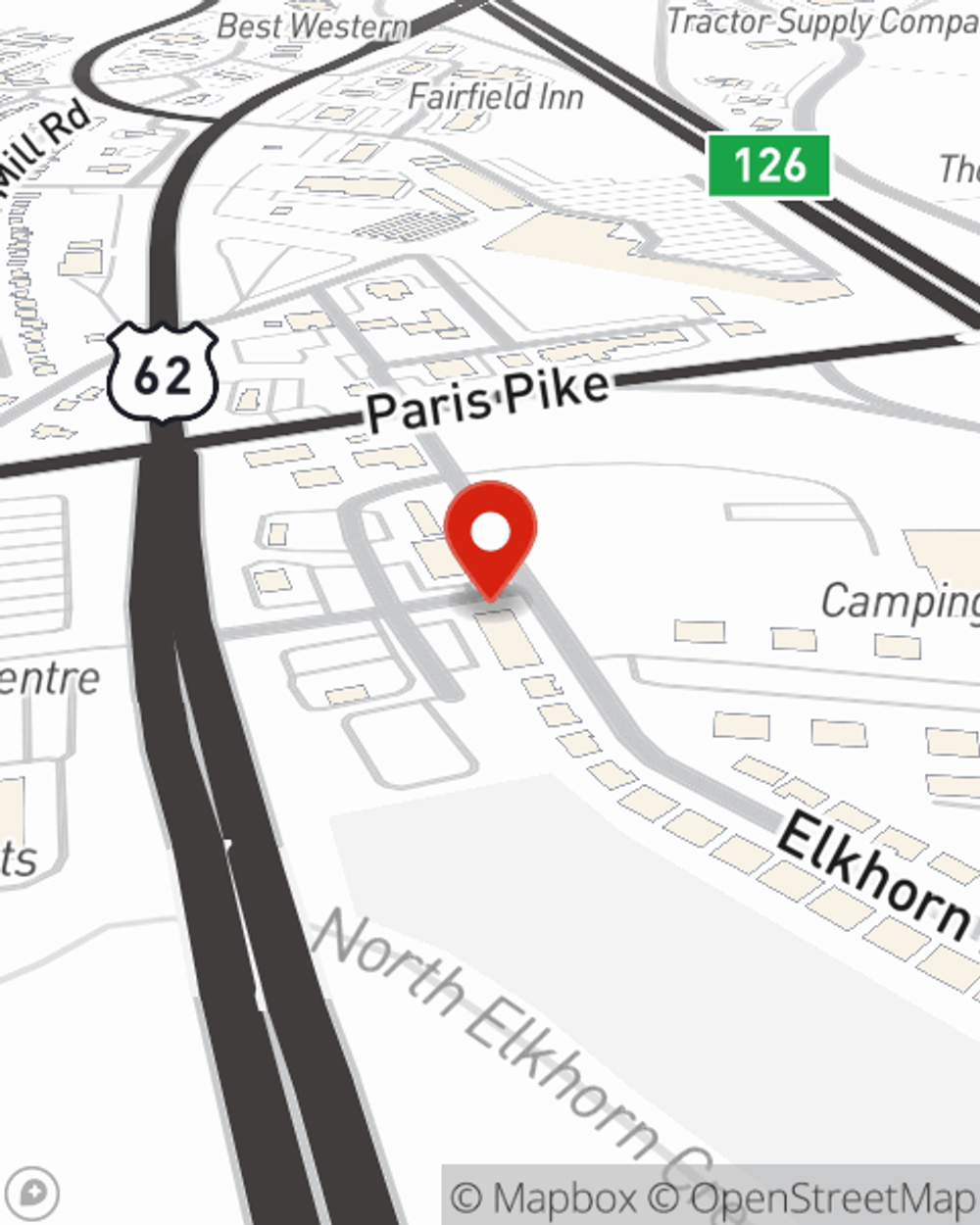

Business Insurance in and around Georgetown

Get your Georgetown business covered, right here!

No funny business here

Insure The Business You've Built.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes catastrophes like an employee getting hurt can happen on your business's property.

Get your Georgetown business covered, right here!

No funny business here

Strictly Business With State Farm

Protecting your business from these potential problems is as easy as choosing State Farm. With this small business insurance, agent Steve Woodrum can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should a problem like this arise.

Do what's right for your business, your employees, and your customers by getting in touch with State Farm agent Steve Woodrum today to explore your business insurance options!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Steve Woodrum

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.